Peerless Tips About How To Avoid Amt Tax

How to avoid alternative minimum tax?

How to avoid amt tax. Next, remove certain tax breaks, such as your deductions for state, local, and property taxes. While doing this can avoid amt, nsos also lose the tax benefits of isos. To avoid this scenario, the government has introduced an amt credit , which acts as a tax credit for individuals who have paid taxes under amt in the previous year.

For example, the two easiest ways to pay less amt are to make less money (and thus owe less tax) and to make more money (and thus owe more under the regular tax system than under the amt). An alternative minimum tax (amt) recalculates income tax after adding certain tax preference items back into adjusted gross income. (solution found) a good strategy for minimizing your amt liability is to keep your adjusted gross income (agi) as low as possible.

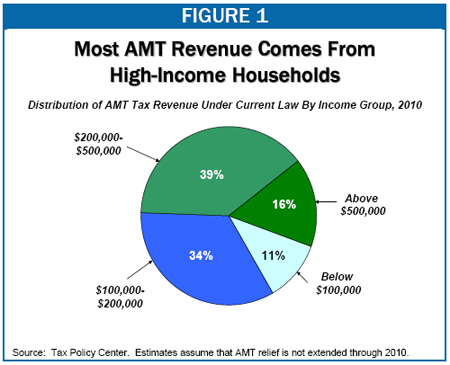

How can i stop amt triggering? The high rates of amt (alternative minimum tax) in comparison with regular income taxes often result in significant amounts of money being owed to the united states government. As with many tax rules, the exemption amount depends on your tax status.

In some cases, people who qualify for the amt may be able to lower their tax bill by making certain changes, such as establishing a qualifying home office or only using home. The law sets the amt exemption amounts and amt tax. For example, the two easiest ways to pay less amt.

Take advantage of a solo 401 (k) 4. Participate in a 401 (k), 403 (b), sarsep , 457. Medical expense deductions are only allowed if they exceed 10% of your adjusted gross income (agi) for both amt and the regular.

6 ways to reduce your amt 1. Subtracting the amt foreign tax credit. Defer income to next year 2.

Multiplying the amount computed in (2) by the appropriate amt tax rates, and; One of the best things that can be said about the alternative minimum tax is that congress was successful in making it difficult to get around this tax. In the tax foundation’s new options for reforming america’s tax code 2.0, there are several options that would simplify the tax code, including eliminating the alternative.

It’s important to understand your amt tax and to choose the best option for your situation. Contribute to your 401 (k) or 403 (b) 3. The following are exemption amounts for 2021:

This strategy works best for employees of public companies who exercise at the beginning of the. Another way to cover the cost of the amt is to sell iso stock (derived from the exercise of the options), or other assets, to get enough cash to pay the amt tax during the same year you. Another way to avoid amt is to sell your iso shares in the same year that you bought.

Then, subtract your amt exemption (if eligible), which for the 2022 tax year is $75,900 for. Defer income to next year.

![Incentive Stock Option Amt Explained [How To Avoid] — Tech Wealth](https://i.ytimg.com/vi/SIw-ttmvnzA/maxresdefault.jpg)